How Offshore Banking Can Increase Your Financial Privacy and Safety

Offshore financial has actually emerged as a practical choice for people looking for to enhance their monetary personal privacy and security. The subtleties of offshore financial prolong past plain privacy; understanding the complete extent of its advantages and ramifications is vital for any individual pondering this financial strategy.

Recognizing Offshore Financial

Offshore financial institutions are normally located in countries recognized for their durable economic services and privacy legislations, such as Switzerland, the Cayman Islands, and Singapore. People and businesses might seek overseas financial solutions for a range of reasons, consisting of possession security, diversification of investments, and accessibility to international markets.

In addition, offshore financial can offer clients the capacity to manage several money and help with worldwide transactions with better convenience. offshore banking. The practice has additionally brought in scrutiny due to prospective abuse for tax obligation evasion and cash laundering, leading to boosted regulatory oversight. As a result, comprehending the intricacies of offshore banking is necessary for browsing both its advantages and pitfalls, especially as global monetary systems progress and federal governments seek greater transparency in monetary deals

Benefits of Financial Privacy

Financial privacy plays a significant role in the appeal of overseas banking, as it uses individuals and companies a layer of security for their assets and personal information. Among the key advantages of improved financial privacy is the ability to shield wealth from unsolicited analysis, which can be specifically helpful for high-net-worth individuals and entrepreneurs. This personal privacy cultivates a feeling of safety, enabling clients to handle their finances without fear of breach or unnecessary influence.

Furthermore, economic privacy can contribute to far better monetary planning. By maintaining sensitive information personal, customers can make calculated decisions without the stress of outside parties. This discernment is vital in maintaining the stability of individual or corporate economic methods.

Additionally, overseas banking can help with international transactions with better discretion. This is particularly advantageous for organizations engaged in international trade, as it allows them to run without exposing their monetary activities to rivals or governing bodies unnecessarily.

Inevitably, the benefits of economic privacy in offshore financial extend past simple discretion; they empower people and businesses to navigate their economic landscapes with confidence and autonomy. This liberty is indispensable in today's interconnected and often inspected economic globe.

Enhanced Safety Attributes

How can offshore banking enhance the safety of individual and company assets? Offshore banks usually give durable security measures that can dramatically protect customers' funds and delicate info. One of the crucial attributes is progressed encryption technology, which secures on the internet deals and information storage, decreasing the risk of her explanation unapproved gain access to.

Additionally, lots of offshore banks lie in jurisdictions with rigid privacy regulations, using a layer of lawful security versus prospective possession seizures or unwarranted scrutiny. This legal structure not just safeguards customer info however likewise guarantees that the bank follows high requirements of confidentiality.

Additionally, offshore financial institutions usually use multi-factor verification protocols, requiring numerous kinds of verification before granting access to accounts. This added layer of security deters fraudulence and improves overall account useful content protection.

In instances of geopolitical instability or economic uncertainty, overseas banks can also give clients with diversified asset defense approaches. By holding possessions in multiple money or investment vehicles, customers can decrease direct exposure to domestic risks. Jointly, these enhanced protection functions make overseas banking an appealing alternative for those seeking to safeguard their funds successfully.

Tax Advantages and Conformity

Offshore banking supplies individuals and firms tactical tax obligation advantages that can improve their overall monetary efficiency. By using overseas accounts in jurisdictions with desirable tax routines, clients can potentially decrease their tax obligations. Many offshore financial institutions run in countries with reduced or absolutely no taxation on earnings, resources gains, and inheritance, allowing depositors to maintain a bigger portion of their incomes.

Nonetheless, it is crucial to stress that taking part in offshore banking needs rigorous adherence to tax obligation compliance policies - offshore banking. International criteria, such as the Usual Reporting Standard (CRS) and the Foreign Account Tax Obligation Conformity Act (FATCA), demand that account holders report their foreign accounts to their home countries. Failure to conform can cause severe fines and legal effects

To optimize the benefits of offshore basics financial, people and companies should guarantee that they take part in clear tax planning and preserve detailed documents. This includes recognizing the tax obligations in both the offshore jurisdiction and their home country. By doing so, clients can delight in the monetary advantages of offshore financial while continuing to be certified with global tax obligation regulations, therefore guarding their economic passions and making certain lasting security.

Selecting the Right Offshore Bank

Choosing the proper offshore bank is a crucial choice that can dramatically affect an individual's or corporation's economic method. To make an informed selection, a number of elements must be considered.

First, evaluate the financial institution's territory. Different nations use varying degrees of regulative oversight, personal privacy securities, and political stability. Go with a jurisdiction recognized for solid banking laws and robust lawful structures, such as Switzerland, Singapore, or the Cayman Islands.

Next, analyze the bank's online reputation and monetary stability. Research study its credit score ratings, testimonials from other customers, and any background of financial misbehavior. A well-established establishment with a strong performance history is crucial for securing your properties.

In addition, consider the variety of services used. Some financial institutions concentrate on wealth management, while others may focus on business services or financial investment chances. Make certain that the financial institution straightens with your specific financial needs.

Conclusion

In verdict, offshore banking offers as an important device for improving financial privacy and safety and security. When executed with adherence to tax obligation policies and mindful choice of institutions, overseas banking inevitably contributes dramatically to a protected and confidential monetary landscape.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Andrea Barber Then & Now!

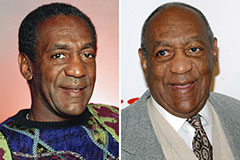

Andrea Barber Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!